The Franchise Disclosure Document (FDD)

The Franchise Disclosure Document, also referred to as an "FDD," is a legal document and prospectus that the FTC requires franchisors to disclose to prospective franchise buyers 14 days before selling a franchise or receiving any fees.

The contents of the FDD are regulated by federal and state franchise laws and within every FDD are 23 disclosure items that include information about the franchisor, the franchisor's management team, estimated start-up expenses, legal obligations, and other information about the franchise opportunity. Within the franchise registration states franchisors must file and register their FDD at the state level.

Every FDD must include the following 23 disclosure items:

- FDD Item 1: The Franchisor and any Parents, Predecessors, and Affiliates

Within FDD Item 1 franchisors must disclose corporate information, including information about affiliated and parent companies of the franchisor. Item 1 FDD disclosures are designed to provide franchise buyers with information about the corporate structure of the franchisor, any affiliated companies, and any predecessors such as a former owner of the franchise system. - FDD Item 2: Business Experience

Within FDD Item 2 franchisors must disclose information about the franchisor's management team. Item 2 FDD disclosures are designed to provide franchise buyers with information about franchisor management, franchise sales, and franchisee support team members, including each team members 5 year employment history. - FDD Item 3: Litigation

Within FDD Item 3 franchisors must disclose certain types of litigation that currently involves or previously involved the franchisor, the franchisor's affiliates, predecessors, and/or individual management team members identified in Item 2. Item 3 FDD disclosures are designed to provide franchise buyers with information about litigation history, the type of litigation the franchisor and team members have been involved in, and the outcome of the litigation. - FDD Item 4: Bankruptcy

Within FDD Item 4 franchisors must disclose whether or not the franchisor, the franchisor's affiliates, predecessors, and/or individual management team members identified in Item 2 previously filed for bankruptcy. - FDD Item 5: Initial Fees

Within FDD Item 5 franchisors must disclose all upfront fees that a franchisee must pay to the franchisor before the franchisee opens the franchised business. The most common initial fees disclosed in Item 5 include the initial franchise fee and other upfront pre-opening fees that may be paid to the franchisor such as fees for opening-inventory and equipment that must be purchased from the franchisor. - FDD Item 6: Other Fees

Within FDD Item 6 franchisors must disclose all other fees that a franchisee must pay to the franchisor throughout the terms of the franchise agreement. These fees typically include on-going royalties, brand development fund, marketing, technology, training, and other fees specific to the franchisor. - FDD Item 7: Estimated Initial Investment

Within FDD Item 7 franchisors must include a low to high estimate of the estimated cost for a franchisee to establish and open the franchised business. This estimate must include everything from build-out costs to reserve capital for the first three months of operation. The biggest expenses in Item 7 relate to expenses related to building-out and equipping the franchised business. - FDD Item 8: Restrictions on Sources of Products and Services

Within FDD Item 8 franchisors must disclose what products and supplies the franchisee must purchase from the franchisor or the franchisor's designated suppliers. Within Item 8 the franchisor must also disclose revenue and rebates that the franchisor earned from selling source-restricted supplies and products to franchisees. - FDD Item 9: Franchisee's Obligations

Within FDD Item 9 franchisors must disclose, in table format, the franchisee's obligations under the franchise agreement. This table includes a summary of all legal obligations ranging from site selection and opening to default provisions and the franchisee's obligations upon termination of the franchise agreement. - FDD Item 10: Financing

Within FDD Item 10 franchisors must disclose whether or not the franchisor offers franchisees financing as to initial fees to be paid by the franchisor or in connection with the franchised business. - FDD Item 11: Assistance, Advertising, Computer Systems, and Training

Within FDD Item 11 franchisors must disclose the type of assistance and training that the franchisor will provide to the franchisee, advertising requirements imposed on the franchisee, and the required computer and software systems that the franchisee will be required to purchase and utilize. - FDD Item 12: Territory

Within FDD Item 12 franchisors must disclose if the franchisee will be awarded a protected territory, whether or not the territory is protected, how the territory will be determined, and instances where the franchisor reserves the right to operate within the franchisees territory. - FDD Item 13: Trademarks

Within FDD Item 13 franchisors must disclose information about the trademarks of the franchise system, including, whether or not they are registered with the United States Patent and Trademark Office, their registration status, and whether or not the franchisor has notice of a trademark conflict or dispute. - FDD Item 14: Patents, Copyrights, and Proprietary Information

Within FDD Item 14 franchisors must disclose information about any patents, copyrights and other proprietary information that is related to the franchise system. - FDD Item 15: Obligation to Participate in the Actual Operation of the Franchise Business

Within Item 15 franchisors must disclose what obligations, if any, the the individual franchisees / franchisee owners must have in the day-to-day operations of the franchised business including whether or not they must work in the franchised business on a full time basis. - FDD Item 16: Restrictions on What the Franchisee May Sell

Within FDD Item 16 franchisors must disclose its control over what a franchisee may or may not sell as a part of the franchised business. - FDD Item 17: Renewal, Termination, Transfer, and Dispute Resolution

Within FDD Item 17 franchisors must disclose and summarize the legal rights and obligations related to the renewal, termination, and transfer of the franchised business. This item must also include a summary as to how legal disputes must be resolved between the franchisor and franchisee. - FDD Item 18: Public Figures

Within Item 18 franchisors must disclose if there are any celebrities or other public figures that have been hired to promote the franchise system. - FDD Item 19: Financial Performance Representations

Within FDD Item 19 franchisors must disclose whether or not it is making any Financial Performance Representations and if it does, the franchisor must provide specific detail within Item 19. - FDD Item 20: Outlets and Franchisee Information

Within FDD Item 20 franchisors must disclose, in five separate tables, a summary of the franchised and corporate outlets over the prior three years and a projection as to future opening in the next year. - FDD Item 21: Financial Statements

Within FDD Item 21 franchisors must disclose and include copies of the Franchisor's Financial Statements. - FDD Item 22: Contracts

Within FDD Item 22 franchisors must list and attach as an exhibit all contracts that a franchisee must sign with the franchisor. These contracts include a sample of the franchisor's standard franchise agreement and related agreements such as a development agreement, site selection agreement, release agreement, and others. - FDD Item 23: Receipts

Within FDD Item 23 Franchisors must include two copies of the receipt page. The receipt page is the page that a franchisee must sign to confirm and prove the proper disclosure and delivery of the FDD.

Franchise Disclosure Document FAQ's

The the issuance date of a FDD is the date that the franchisor designates its FDD as being complete and in compliance with federal franchise laws. Compliance and the determination of the issuance date is a self-certifying process in that there is no federal agency that reviews or registers FDDs. At the state level, within the franchise registration states, the FDD must be registered with a state examiner who will, after a review process, grant or deny registration.

Under the Federal Franchise Rule, the FDD must be disclosed to a prospective franchisee not less than 14 days prior to the prospective franchisee signing a franchise agreement or paying any money to the franchisor. Disclosure of the FDD by itself is not enough; commencement of the 14-day period is governed based on the day that the franchisee signs the FDD receipt page contained in Item 23 of the FDD. Certain states have modified this 14-day period. Learn more about the FDD disclosure period.

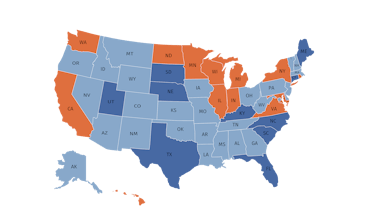

When dealing with the franchise registration states, the FDD must be filed and registered with a state franchise examiner before offering or selling a franchise within the state.

When dealing with the franchise registration states, if (a) the prospective franchisee resides in a franchise registration state, (b) the franchised business will be developed and located within a franchise registration state, or (c) the franchisor is marketing/offering the sale of franchises in a franchise registration state, then the FDD must be registered in that state. Also, New York franchisors (i.e., franchisors incorporated in New York or who operate from New York) must register their FDDs in New York (in addition to the other states) whether or not the franchisee or franchised business is located in New York.

Yes. Within the franchise registration states, FDD registration must be renewed on an annual basis within 120 days of the franchisor’s fiscal year end. Since state examiners will need time to review a franchisor’s registration renewal application, it is important for franchisors to submit their renewal applications well before the 120-day renewal deadline - otherwise a franchisor risks “going dark” in that state, whereby their initial registration expires before renewal is granted.

Every year, the FDD needs to be updated and FDD registrations must be renewed. To learn more about the franchise registration states and state-specific requirements for registering and filing an FDD, visit our interactive franchise registration map.

The FDD must be issued and updated no less frequently than annually, within 120 days of the franchisor’s fiscal year end. However, if there are material changes in the information contained in the FDD, then the FDD must be updated on a quarterly basis or immediately for material or misleading information. Learn more about when the FDD needs to be updated.

Yes. As a part of FDD Item 21, the FDD must contain audited financial statements of the franchisor. However, in most states, for new franchisors that have not previously offered or sold franchises, there is a partial financial statement phase-in exemption wherein a start-up franchisor may initially issue its FDD with an unaudited opening balance sheet. However, many registration states do not recognize this phase-in process. Learn more about the financial statements that have to be included in the FDD.

If during the franchise sales and negotiating process a franchisor makes changes to the franchise agreement, if those changes were negotiated changes requested by the franchisee and for the benefit of the franchisee, then the franchisor does not need to amend its FDD. Franchisors should be cautious as to negotiated changes to the franchise agreement, as FDDs most likely contain a representation that a franchise offering is “uniform” as to what the franchisor offers and grants to franchisees.

Because the FDD must be provided to prospective franchisees before selling a franchise or accepting any fees, the FDD is an integral part of the franchise sales process.

When evaluating and comparing franchise systems, prospective franchisees and franchise brokers will compare and evaluate your FDD from a business perspective as to how well your franchise offering stacks up against your competitors. Consider some of the following business points:

- Within the FDD, you will be disclosing the type of franchise that you are offering, the initial franchise fee that you charge, and the ongoing royalties that franchisees will be required to pay to you. When developing your FDD, you very much need to consider the unit economics of your franchise offering, how your system stacks up against others, and whether or not your franchisees will have a fair shot at generating a good return on investment; and

- If prepared correctly, your FDD must be customized to your business and your franchise growth plan. When developing or updating your FDD, some of the business questions and points that you should address include:

- What Franchise Structure Are You Offering? Are you offering a single franchiseopportunity where a franchisee establishes one operating unit, or do you have dual structure where a franchisee may also sign a development agreement and possess the right to establish, for example, up to three operating units?

- Do You Offer Multiple Development Opportunities? Does your franchise model and FDD support only one type of operating unit, or will a prospective franchisee have a choice in selecting the type of operating unit he or she wants to establish, i.e., a full-service location, or alternatively a more limited service express-type operating unit?

- What’s Your Royalty Structure? Are franchisees required to pay you a royalty fee that is a fixed percentage of gross sales, or have you adopted an alternate model of a fixed-fee royalty or possibly even a no-royalty structure?

- Do You Offer a Protected Territory? Are franchisees granted a protected territory? And if they are, how does your FDD and franchise agreement address issues involving competition between franchisees, and the use of digital and other media that is widely distributed? Are there exceptions for alternative channels of distribution?